Sales Tax For Franklin County Ohio – Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. For sellers, the challenge lies in pricing items fairly and accurately representing their condition. Quality goods transcend trends and fleeting fads. They remind us that, despite living in a world where everything is for sale, there are some things that remain priceless. On the other hand, buyers may seek to negotiate lower terms based on the findings from their due diligence or their assessment of the business’s future potential. Additionally, purchasing second-hand electronics can be a way to access high-end models at a lower price. One of the most popular categories of second-hand goods for sale is clothing. Are there things that should be kept beyond the realm of trade? Or has the marketplace — with its insatiable demand and promise of exchange — seeped into every facet of our being?

If everything is for sale, then the concept of value itself becomes fluid, subjective, and often manipulated. A well-made product simply performs better. But in reality, even the most profound relationships can be commodified in some way. The second-hand market is not just about saving money; it’s about embracing a more sustainable, mindful way of consuming that values reuse, repurposing, and the stories behind the items we choose to keep. When people buy second-hand items, they are extending the life cycle of those goods, which means fewer products end up in the trash. While some people may be hesitant to purchase pre-owned electronics due to concerns about quality or reliability, the second-hand market for electronics has become increasingly trustworthy. Many people continue to resist the notion that everything has a price, and they fight to reclaim what is meaningful and valuable in life. Our emotional lives, our personal narratives, and even our deepest fears have been monetized. Once an agreement is reached, the final step is the legal transfer of ownership. There is also a growing trend of online platforms that facilitate the buying and selling of businesses. For some, selling something may feel like a sacrifice, while for others, it may feel like an investment in their future. Additionally, trends in sustainability and eco-conscious living have contributed to the growth of the second-hand market, as consumers become more aware of the environmental impact of their purchasing decisions. Additionally, many second-hand items are still in excellent condition, having been gently used or well-maintained by their previous owners, further enhancing the appeal of these products.

Ohio Sales Tax By County 2024 Josey Mildrid

The franklin county, ohio sales tax is 7.50%, consisting of 5.75% ohio state sales tax and 1.75% franklin county local sales taxes.the local sales tax consists of a 1.25% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). Starting april 1, the total sales tax in franklin county will be 8%,.

Franklin County Ohio Sales Tax Rate 2018 Tax Walls

The minimum combined 2025 sales tax rate for franklin county, ohio is 7.5%. The ohio sales tax rate is currently 5.75%. The sales and use tax rate for franklin county (25) will increase from 7.5% to 8.0% effective april 1, 2025. Ohio has a 5.75% sales tax and franklin county collects an additional 1.25%, so the minimum sales tax rate.

Franklin County Ohio Sales Tax Rate 2024 Windy Kakalina

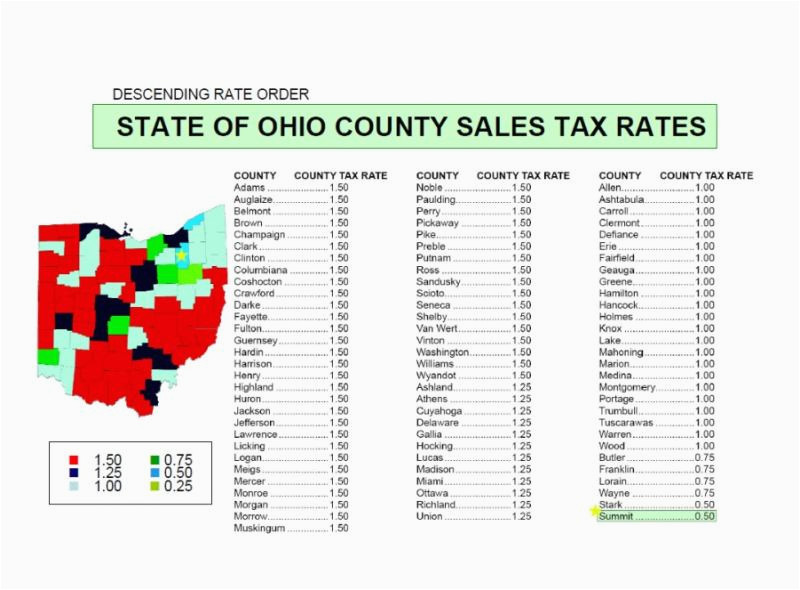

The 7.5% sales tax rate in columbus consists of 5.75% ohio state sales tax, 1.25% franklin county sales tax and 0.5% special tax. The sales and use tax rate for licking county's cota district (94) will increase from 7.75% to 8.25% effective april 1, 2025. Click here for a larger sales tax map, or here for a sales tax table..

Franklin County Ohio Sales Tax Rate 2024 Yoshi Katheryn

The franklin county, ohio sales tax is 7.50%, consisting of 5.75% ohio state sales tax and 1.75% franklin county local sales taxes.the local sales tax consists of a 1.25% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). Click any locality for a full breakdown of local property taxes, or visit.

Ohio Sales Tax By County 2024 Josey Mildrid

The current sales tax rate in franklin county, oh is 7.75%. The franklin county, ohio sales tax is 7.50%, consisting of 5.75% ohio state sales tax and 1.75% franklin county local sales taxes.the local sales tax consists of a 1.25% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). The sales.

Ohio Sales Tax Calculator and Local Rates 2021 Wise

Currently, the state imposes a 5.75% sales tax on most sales and services. Ohio has a 5.75% sales tax and franklin county collects an additional 1.25%, so the minimum sales tax rate in franklin county is 7% (not including any city or special district taxes). Franklin county’s sales tax rate is 1.25%. There are a total of 576 local tax.

Ohio Sales Tax Calculator

This is the total of state, county, and city sales tax rates. This variation is due to some cities imposing additional rates or special tax rates that apply only to specific cities. Click here for a larger sales tax map, or here for a sales tax table. This table shows the total sales tax rates for all cities and towns.

Franklin County Ohio Sales Tax Rate 2024 Yoshi Katheryn

The current sales tax rate in franklin county, oh is 7.75%. The 7.5% sales tax rate in columbus consists of 5.75% ohio state sales tax, 1.25% franklin county sales tax and 0.5% special tax. Ohio has 1,424 cities, counties, and special districts that collect a local sales tax in addition to the ohio state sales tax. Ohio has state sales.

Franklin County Ohio Sales Tax Rate 2024 Yoshi Katheryn

Currently, the state imposes a 5.75% sales tax on most sales and services. There is no applicable city tax. There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.5%. Ohio has 1,424 cities, counties, and special districts that collect a local sales tax in addition to the ohio state sales tax..

Franklin County Ohio Sales Tax Rate 2018 Tax Walls

There is no applicable city tax. Franklin county’s sales tax rate is 1.25%. The current sales tax rate in franklin county, oh is 7.75%. The minimum combined 2025 sales tax rate for franklin county, ohio is 7.5%. Currently, the state imposes a 5.75% sales tax on most sales and services.

A car is something that can hold a great deal of sentimental value. The idea of being “for sale” also touches on larger cultural and societal themes. The production of new goods often requires significant resources, such as raw materials, energy, and labor, while also generating waste and contributing to pollution. They believe that certain things, like love, loyalty, and friendship, should be above the reach of commerce. For people looking to furnish their homes, build a wardrobe, or invest in certain hobbies or collections, second-hand goods often provide a way to access items they might otherwise be unable to afford. A person might sell a beloved possession to fund an important life change, such as starting a business, moving to a new city, or pursuing a dream. For the seller, the goal is to achieve the highest price possible for the business, while for the buyer, the goal is often to secure a fair price that reflects the true value of the business. Similarly, during periods of economic growth, there may be a greater willingness to spend on luxury second-hand items, such as high-end fashion or collectible items. Just as with material possessions, when a person is “for sale,” they put their value on display for others to assess. Moreover, buying second-hand items allows consumers to access unique and vintage products that may no longer be available in stores, offering a sense of individuality that is often missing from mass-produced, new items. Online marketplaces have opened up opportunities for people to buy and sell goods from the comfort of their own homes. We start to treat people as commodities, too — as means to an end, as tools for achieving personal success or social status. Millennials and Gen Z, in particular, have embraced the idea of second-hand shopping as a way to challenge consumerism, reduce waste, and express their individuality. For those who enjoy the tactile experience of shopping and the sense of discovery that comes with it, thrift stores offer a personal and immersive way to shop for second-hand items. One of the most popular categories of second-hand goods for sale is clothing. However, buying a business is not a decision to be taken lightly. Art, music, literature — these expressions of human creativity and emotion are not always bound by the rules of commerce. In this sense, online second-hand markets have not only made pre-owned goods more accessible but have also made them more desirable, offering an alternative to the mass-produced, one-size-fits-all nature of new products. In fact, there’s been a resurgence of interest in artisanal, locally-made products, especially in industries like fashion, home decor, and food. In some cases, sellers may be willing to offer financing options, where they agree to receive payment over time, which can make the business more attractive to potential buyers.

The concept of “for sale” stretches beyond physical items. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. Whether buying vintage clothing, upcycled furniture, or pre-owned electronics, the growing popularity of second-hand shopping reflects a broader desire for more sustainable, creative, and conscious ways of living. These goods, ranging from clothing to furniture, electronics to books, offer people the chance to find items they need or want at a fraction of the cost of new products. These platforms provide a convenient way for sellers to connect with potential buyers, set their prices, and arrange for shipping or pick-up. When consumers buy these goods, they are investing in both the product and the people behind it. When you buy something made from premium materials, crafted with attention to detail, and tested for reliability, you can expect it to deliver value that surpasses its initial cost. People are not just looking for things that work well; they want products that elevate their environment and their experiences. In conclusion, second-hand goods for sale represent more than just a financial transaction; they embody a shift toward sustainability, individuality, and social responsibility. Vintage clothing, in particular, has gained a significant following, with people seeking out unique, one-of-a-kind pieces that cannot be found in mainstream stores. This subjective nature of value is what makes the “for sale” market so dynamic. Relationships can become transactional, where each party enters into an agreement based on what they stand to gain. It involves an in-depth understanding of the business’s financials, operations, and market position. Whether it’s an item, a service, or even a person, the act of being “for sale” represents a moment of transition, a shift from one stage of life to another. Are there things that should be kept beyond the realm of trade? Or has the marketplace — with its insatiable demand and promise of exchange — seeped into every facet of our being?

If everything is for sale, then the concept of value itself becomes fluid, subjective, and often manipulated. For the buyer, purchasing a home is a dream realized, a step toward security and stability. The ease and convenience of online sales have created a global marketplace where individuals can connect with buyers and sellers across the world. Many sellers of second-hand electronics offer refurbished items, which have been inspected, repaired, and restored to a like-new condition. Social media platforms, for example, offer users a chance to buy into their own identity, to curate a version of themselves that is more appealing, more desirable, more marketable. For example, someone might be able to purchase a used smartphone or laptop with the same features and specifications as a brand-new model, but at a significantly reduced price.